In the 2024-2025 tax year, the average council tax charge for a Band D property is £2,171 a year in England, £2,024 a year in Wales and £1,421 in Scotland.

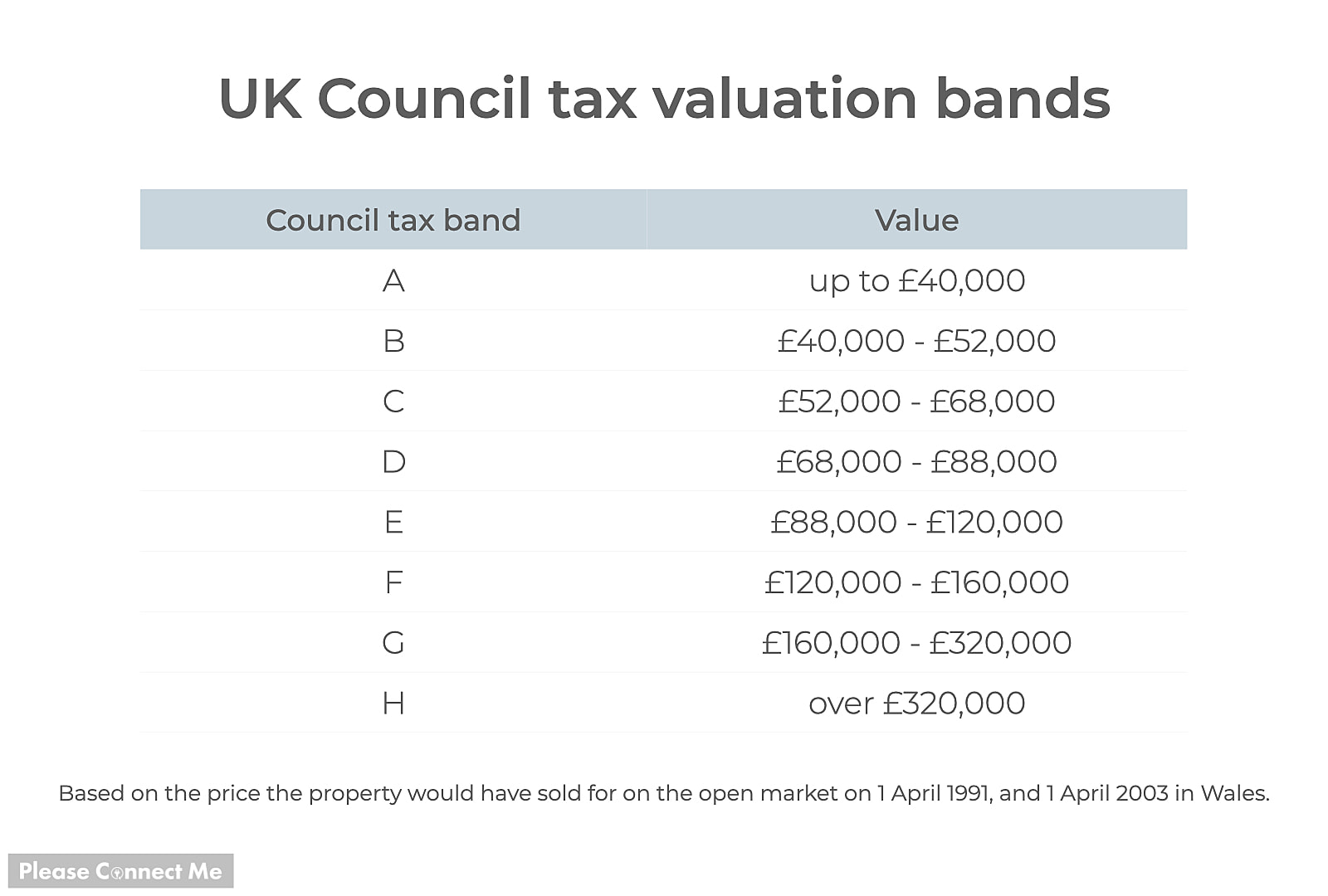

Council Tax bands range from A (the lowest band) the H (the highest band), with band D being considered typical for a family home.

The amount of Council Tax you’ll pay depends on the area you live in and the rateable value of your home, which decides your Council Tax band.

What is Council Tax?

Council Tax is a fee you pay to your local authority – the council – for essential services and maintenance in your local area.

Each local authority sets its own Council Tax values for properties from Band A to Band H. These values are adjusted every tax year, starting from April 1st.

The band assigned to your property depends on the value it would have sold for in 1991, or 2003 for properties in Wales.

What’s the average Council Tax bill in the UK?

Average Council Tax bills are given based on Band D properties, as these are considered typical family homes. However, there’s a huge range of possible Council Tax charges based on the value of your home and the area you live in.

In the table below, we’ve shown the range of potential charges for each property band for the UK’s lowest and highest taxed areas, Wandsworth and Rutland respectively.

|

Property Band |

Council Tax Range |

|

Band A |

£640.77 – £1,695.53 |

|

Band B |

£747.55 – £1,978.11 |

|

Band C |

£854.35 – £2,260.70 |

|

Band D |

£961.14 – £2,543.29 |

|

Band E |

£1,174.74 – £3,108.47 |

|

Band F |

£1,388.32 – £3,673.64 |

|

Band G |

£1,601.91 – £4,238.82 |

|

Band H |

£1,922.29 – £5,086.58 |

Based on annual Council Tax totals in the Wandsworth and Rutland local authority in tax year 2024/25.

Do bigger houses pay more council tax?

It’s often assumed that the bigger a house is, the more council tax the residents will have to pay.

In reality, your council tax band is based on a combination of the size of a property, its layout, its features and its condition.

This means that a smaller house might be in a higher band than a larger house if it’s considered more valuable for other reasons.

Can I cut my council tax bill?

There are a few different ways to reduce your council tax bill in the UK. If you live alone, for example, you can claim a 25% single-occupant discount on council tax.

If everyone who lives in the property is a full-time student, you are exempt from council tax. You still need to register with your local authority, but then you do not need to pay any council tax at all.