Could you be paying too much Council Tax?

Your Council Tax bill is based on the value of your property and the area you live in. Add in the possible available discounts and it can be hard to tell if you’re paying the right amount.

If you think you are overpaying for Council Tax each month, use our tips below to investigate and save.

How is Council Tax Calculated?

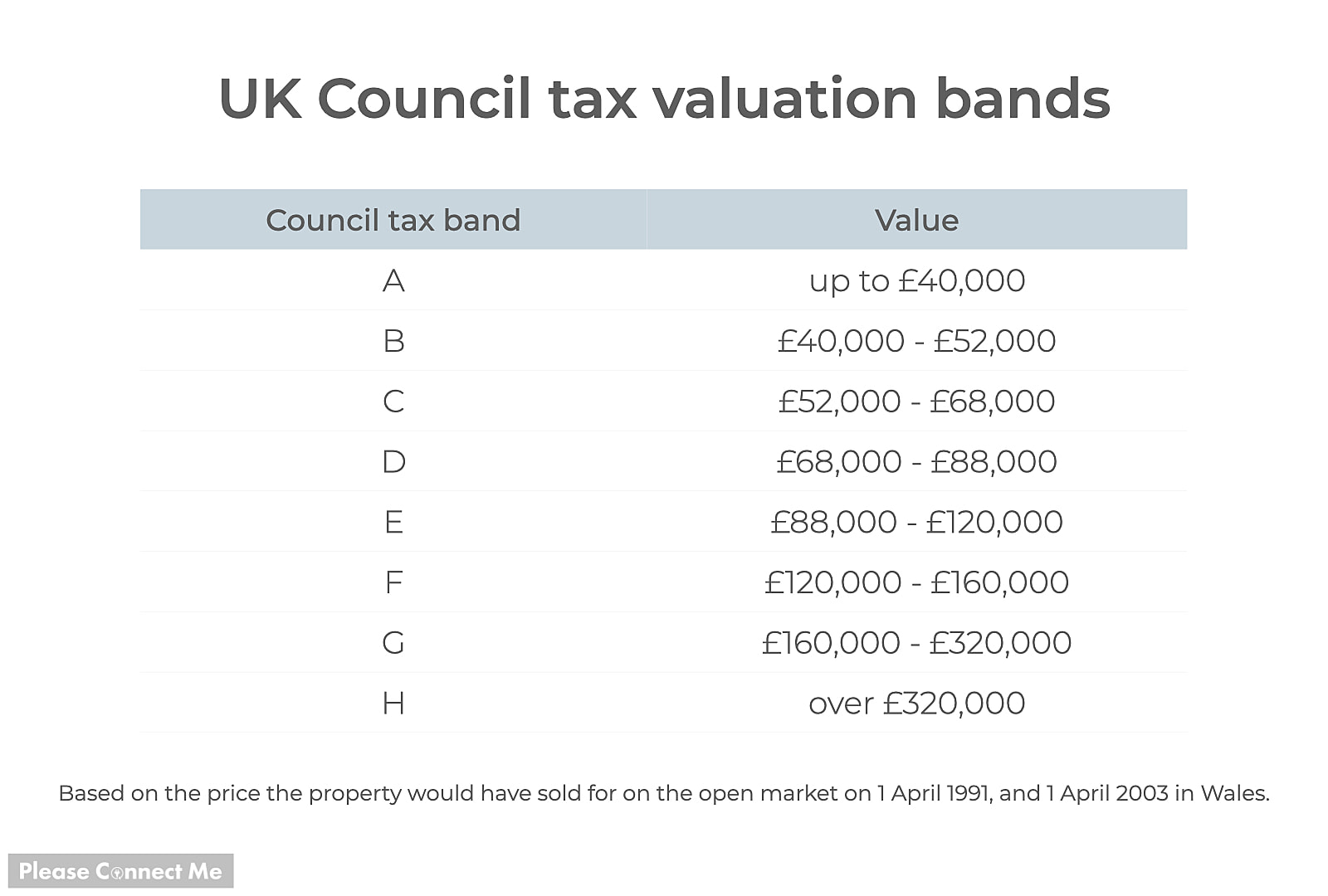

The amount you’ll pay in Council Tax depends on two things – the value of the property and what local authority you live in. Every property in the UK is given a Council Tax band between A and H, based on what the property would have sold for in 1991. You can see the specific values for all 8 Council Tax bands below.

Each local authority then decides how much each band will pay for Council Tax as part of their local budget. Properties in the same band can pay very different amounts in tax depending on their location.

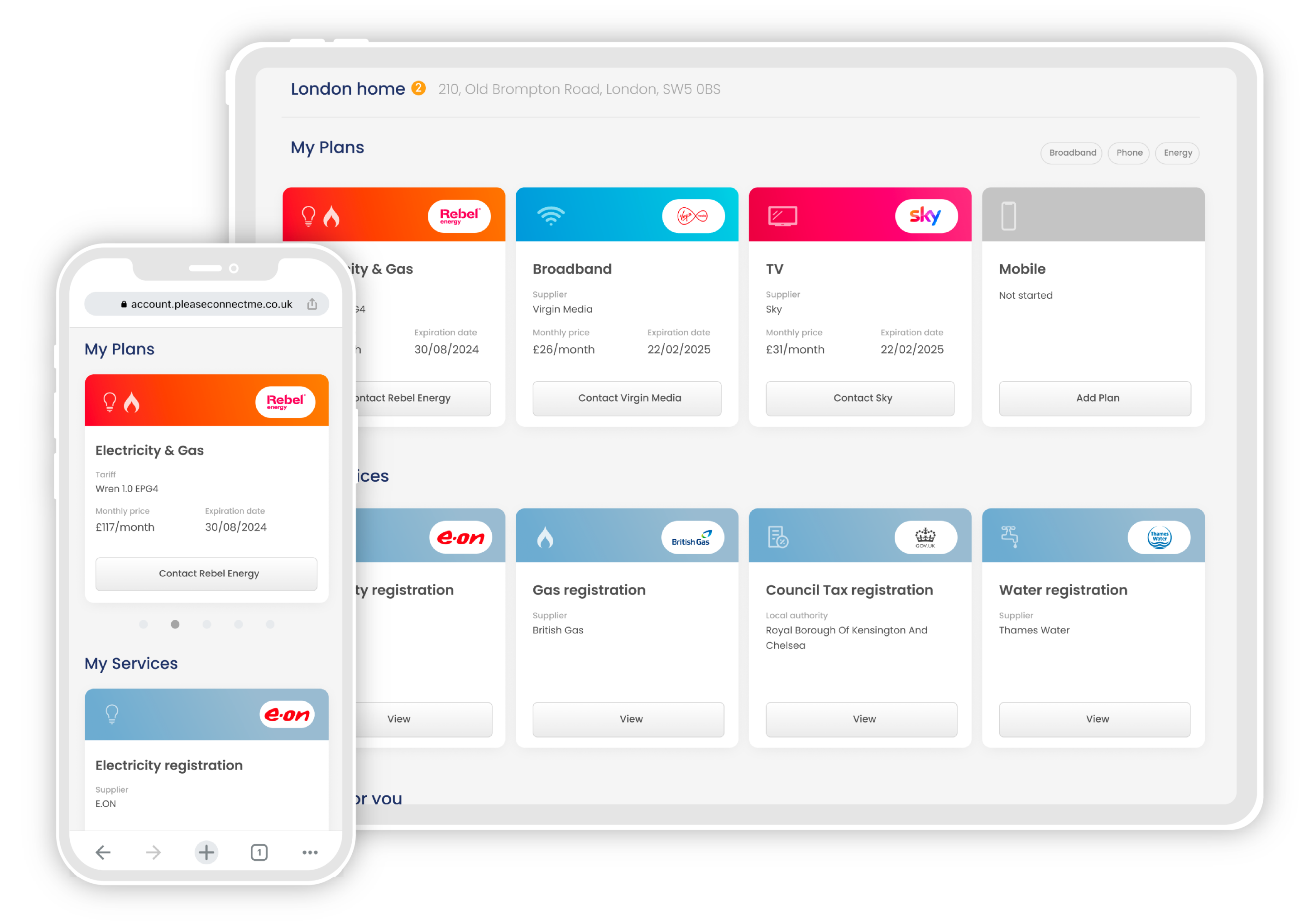

How much Council Tax am I paying?

You can find your annual cost for Council Tax printed on your bill, which will be sent to you by post. When registered for your Council’s online services you can also see your bill total through your account.

If you live in London, use our Council Tax Checker to see how much your bill will be.

Is my property in the correct band?

If you think you’re paying too much Council Tax, it’s possible that your band might be wrong. The best way to check this is to look for the most similar – ideally identical – homes on your street. Then you can check what Council Tax band they are in using the public database. If the band of identical properties is lower, your property might be in the wrong band.

If you have a good reason to believe your band is wrong, you can request to have it investigated – but be warned! Your Council can raise your band instead of lowering it. If this happens your (and sometimes your neighbour’s) bills will increase. On top of this, you may have to pay for the assessment costs if your band doesn’t change.

Could I get a discount or exemption from Council Tax?

If you haven’t applied for any discounts or exemptions you qualify for, you could be paying too much Council tax.

Full-time students are completely exempt from Council Tax. If everyone in your home is a student you will not have to pay anything at all. Some people are not included (‘disregarded’) when counting how many people live at a property, including children under 18, student nurses, diplomats and live-in carers. If everyone living in a household is ‘disregarded’, you’ll receive a 50% discount on Council Tax.

If you live alone, or if everyone else in your household is exempt or ‘disregarded’, you’ll get a 25% discount on your bill. You can see the full list of who qualifies for discount and exemption and the evidence you may be asked to provide on the UK Government’s website.

Remember: You must register for Council Tax, even if you are exempt. Non-registration can result in fines and legal action. Once you register for Council Tax, you can apply for your discount online, by phone or by post.

Want to save time? Book a free call with Please Connect Me and we’ll set up your Council Tax, Water, Energy and more in one call. We save the average mover seven hours of admin!