What does Council Tax pay for? Most households in the UK pay Council Tax to their local authority. The amount of tax paid is based on the value of their home, the rates set by the local council and if they’re eligible for a Council Tax discount.

You’re probably curious how your local council spends your taxes. While the exact breakdown varies between areas, we’ve outlined the major uses of council tax below.

You might be surprised at how many times a day you use a service paid for by your taxes!

Which services does council tax pay for?

The main services Council Tax covers include:

-

Police and fire services

-

Leisure and recreation facilities, including parks

-

Libraries and education

-

Care for older residents and those with disabilities

-

Waste collection, disposal and recycling

-

Road maintenance, including street cleaning and lighting

-

Administration, including updating birth, death and marriage records

The largest single portion of tax goes towards social care for children and vulnerable adults.

Emergency services including the fire department are funded through council tax.

What else does council tax pay for?

What local authorities can spend tax revenue on is controlled by the Chartered Institute of Public Finance and Accountancy.

Outside of the essential services listed above, council funds can be used as needed, as long as it’s approved by the CIPFA. This spending might include things like support for the voluntary sector, maintenance of cemeteries, community development, support for those experiencing homelessness and more.

Your local authority will regularly publish reports on how they are spending tax revenue. In addition to these reports, they’re also required to open their detailed financial records to the public for at least 30 days every year, during which you can look into any spending you are curious about.

Who pays council tax?

Most people aged 18 and over pay council tax in the UK. If you are in full-time education, you are exempt from council tax provided every member of your household is also studying. Read more about how to apply for student Council Tax exemption here.

You could also qualify for a discount on your council tax, for example, if you are the only resident at your address who’s over the age of 18 or if some residents are ‘disregarded’. To learn more about Council Tax discounts in the UK, including how to apply if you’re eligible, read our complete guide here.

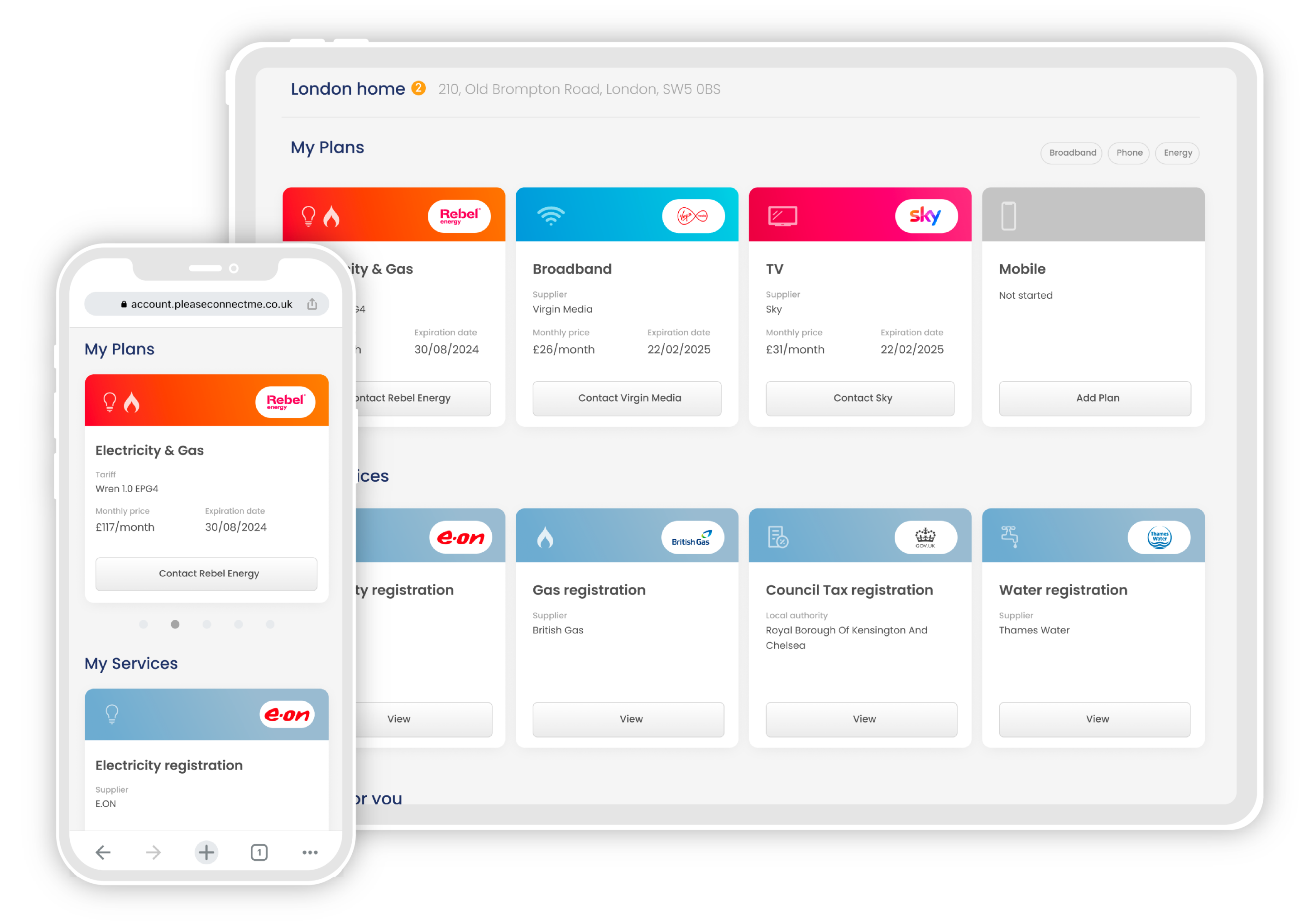

If you’re moving and need to set up Council Tax, there’s an easy way to save time and effort. Book a free call with Please Connect Me and get all your utilities set up, plus save on your bills with our exclusive partner discounts.

Read more about Council Tax in the UK: