Chancellor Rachel Reeves has announced the 2026 budget, outlining planned government spending over the next 12 months and beyond.

While the budget covers everything from minimum wage increases to pensions, we’ve focused on the changes announced that will affect everyday household bills and running costs for those living in the UK.

Here are the changes you can expect to have an impact on your bills in 2026.

Energy bills in 2026

The 2026 budget includes changes to Green Levies

Green levies – payments that fund investment in green energy and environmental protection schemes – have been part of consumer energy bills for more than a decade.

Now, these funds will be raised by general taxation, instead of directly through customer energy bills. The changes to these green levies in the 2026 budget are expected to save the average household £88 a year. A further £59 average saving will come from scrapping a customer-funded scheme that helped low-income households improve their insulation.

In total, these two changes are expected to save the average household around £150 a year on bills, and low-income households up to £300 a year. This is especially welcome given the news that energy bills are set to rise in January, and are predicted to rise again in April.

Energy Price Cap

The Ofgem Energy Price Cap, which sets the maximum price a supplier can charge for each unit of energy, has been announced for the first quarter of 2026.

In the January price cap, a household with typical usage with dual-fuel Direct Debit will pay £1,758 on energy bills per year – a small increase from the current price cap of £1,755. Gas unit rates will fall slightly (from 6.29p to 5.93p/kWh), while electricity unit rates will see an increase (from 26.35p to 27.69p/kWh).

| %Change (Jan–Mar 2026 vs. Oct–Dec 2025) | Impact on annual bills | Primary reason | |

|---|---|---|---|

| Energy price cap | Up 0.2% | £3 Increase (to £1,758) | Government Policy & Network Costs |

| Electricity unit rate | Up 5.1% (to 27.69p/kWh) | Rises for High Electricity Users | Policy costs (Warm Home Discount, Nuclear RAB Levy) |

| Gas unit rate | Down 5.7% (to 5.93p/kWh) | Falls for High Gas Users | Falling wholesale gas prices |

| Electricity standing charge | Up 2% (to 54.75p/day) | N/A | Operating Costs |

| Gas standing charge | Up 3.1% (to 35.09p/day) | N/A | Operating Costs |

New Council Tax payments for top band properties

The 2026 budget also includes tax increases for those in the top three bands of property values – F, G and H. For the first time since 1991, properties in these bands will have their value reassessed.

| Property Value | Additional Annual Surcharge |

|---|---|

| £2m to £2.5m | £2,500 |

| £2.5m to £3.5m | £3,500 |

| £3.5m to £5m | £5,000 |

| £5m+ | £7,500 |

On top of the existing Council Tax, homes worth over £2m will have to pay a surcharge, based on the value of the property. Properties valued between £2m and £2.5m will pay £2,500, properties valued between £2.5m and £3.5m will pay £3,500, properties valued from £3.5m to £5m will pay £5,000, and properties valued at more than £5m will pay an additional £7,500 in tax.

These changes will come into effect from 2028, once the work calculating current property values across the UK is completed.

Top tip! Don’t overpay – check your Council Tax band and find out how to contest it here

Electric cars will be more expensive to run

It’s bad news for those who have installed an electric car charger at home to save on transport costs. A new mileage-based tax for electric vehicles and plug-in hybrid cars will be introduced from 2028.

| Vehicle Type | New Mileage Tax (per mile) |

|---|---|

| Electric vehicles | 3p |

| Plug-in hybrids | 1.5p |

On top of current road taxes, electric car drivers will pay 3p per mile they drive, while plug-in hybrid drivers will pay 1.5p per mile. These rates will then be adjusted each year in line with inflation.

Meanwhile, the current 5p cut on fuel duty for petrol and diesel vehicles has been extended to September 2026, after which point it will be gradually increased to return to pre-cut levels.

Stay on top of your bills in 2026 and beyond

The 2026 budget is a mixed bag for UK households in terms of running costs. Most will see energy bills drop, though for many, these savings will come at the cost of increased taxes elsewhere.

Meanwhile, the proposed ‘mansion tax’ will add thousands of pounds to Council Tax bills for those in high-value properties and areas.

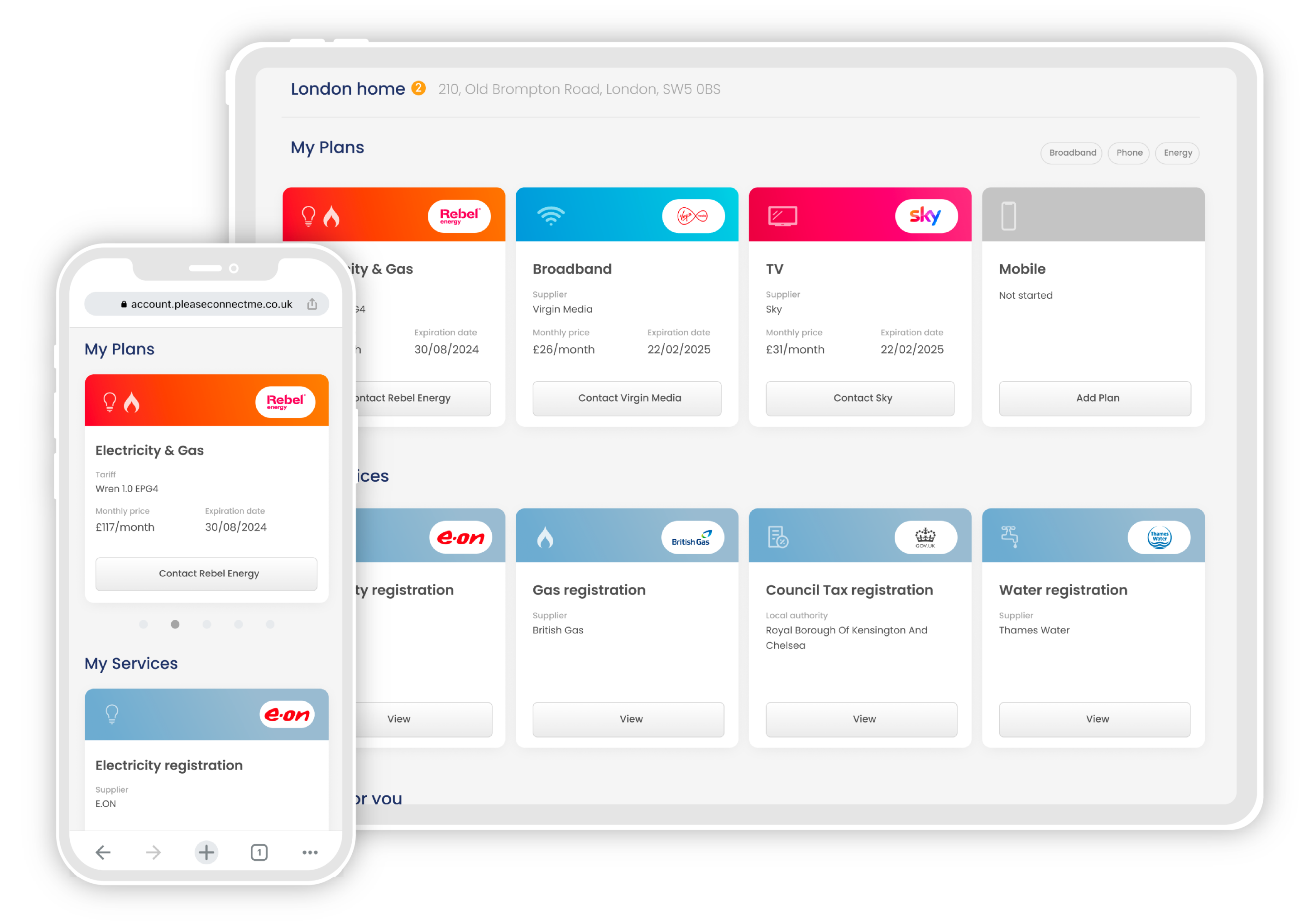

If you’re moving and are concerned about rising bills, book a free call with our Connections Experts today. Our team can help with anything from switching you to a better value energy tariff and checking which Council Tax discounts you qualify for to getting you a great deal on broadband, mobile and more.